City of Detroit issued the following announcement on Jan 26.

Neighborhood home values increased by average of 30% in 2021; homeowners protected from large tax increases

- City mailing out notices of 2022 proposed assessment changes this week

- 203 out of 208 residential neighborhoods saw value increase compared to 2021

- Value increases continue 5-year trend

- Homeowners protected by 3% cap on taxes increases this year

- Property owners can appeal assessments until February 22 at the Assessors Review

It’s important to note, while property values in the city have increased steadily, homeowners are protected against large property tax increases. Under state law, the annual increase in property taxes is capped at the consumer price index (CPI) or five (5) percent, whichever is lower, as long as ownership has not changed. When a home sells, the cap is lifted and the taxable amount adjusts to the State Equalized Value the year following the transfer.

“This steady rise in property value is a reflection of ongoing improvements in neighborhoods such as blight removal, park improvements, commercial corridor upgrades, and other key city services,” said Mayor Duggan. “Home values in nearly every neighborhood are rising and helping to build new wealth, without significant tax increases. These numbers show that while there is still a lot of work to do, the city’s revitalization has reached nearly every corner of our city.”

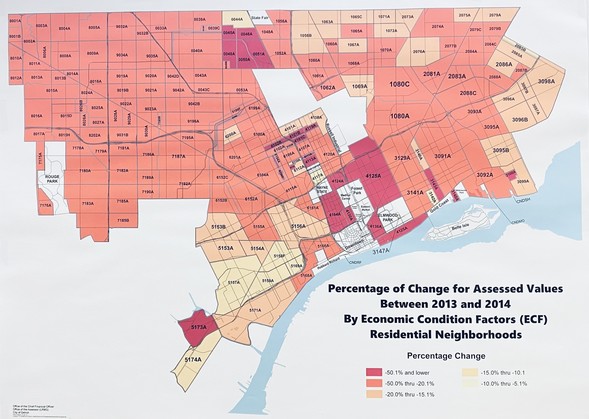

Major shift from 2014-2022

When Mayor Duggan took office in 2014, the city’s residential values were in a tailspin and had lost an estimated $3 billion in value since 2010. To help struggling homeowners, Duggan announced a 22% cut in residential assessments in his first month in office, followed by further cuts in 2015 and a citywide revaluation. In 2016, some areas of the city began to see modest growth in residential property values, however, those areas were confined to downtown, midtown, and a few strong neighborhoods. Since 2018, the value of residential property in Detroit has increased by more than 60 percent overall in Detroit.

In 2019 assessments, the city’s class of residential properties gained about $400 million in value compared to the year before. In the 2020 proposed assessments, the residential property class grew by over $600 million, bringing the city’s gain in residential value over those two years to more than $1 billion, a 35% increase in residential property value over two years. From 2021 to 2022, residential properties have increased in value almost $500 million dollars over the previous years, an increase of 11.3%.

From a 2017 low of $2.8 billion dollars, the value of residential property in Detroit now stands at $4.8 billion tentatively.

“This strong property value growth provides greater stability not only in our neighborhoods but also for city’s economy and revenues,” said Chief Financial Officer, Jay Rising.

Market sales determine assessed value.

To determine this year’s assessment, the city examined two years ( April 1, 2019, through March 31, 2021) of actual market sales. This year that included 60,704 transfers of all types, including market sales, quick claim deeds, and land contracts. From that number, 14,200 met the definition of market value and were used to compute the tentative 2022 Assessments. The Office of the Assessor reviews aerial and street-level imagery of properties to determine valuation. Here is a breakdown of this year’s assessed residential value changes across the city’s 208 residential neighborhoods defined by the Office of the Assessor:

- 21 out of 208 neighborhoods (10%) had an increase in value over 50%

- 91 out of 208 neighborhoods (44%) had an increase in value ranging from 49% to 30%

- 85 out of 208 neighborhoods (41%) had an increase in value ranging from 29% to 10%

- 6 out of 208 neighborhoods (3%) had an increase in value ranging from 9 to 1%

- 5 out of 208 neighborhoods (2%) lost value, but none greater than 6%

Notices will be mailed beginning next week, January 24, 2022, to the city’s over 408,000 residential, commercial, industrial, and personal property owners, advising them of their proposed assessments for 2022. These are not tax bills. Actual bills will be mailed out at the end of June (summer) and November (winter) by the City of Detroit’s Office of the Treasury.

Deadline for assessment appeals extended

Under state law, property owners have the right to appeal the proposed changes. The proposed 2022 Assessments are tentative until the completion of the local review period in March and any possible changes from the Wayne County Assessment and Equalization Department in April.

Residents will have three weeks to appeal all assessments, the City of Detroit has permanently extended the Assessor Review from February 1st through February 22nd, Monday through Saturday. The Assessors Review appeal process will take place remotely this year and we encourage all property owners to take advantage of their right to question how their property is valued during this time. We encourage appeals online, by letter or email. Anyone wishing to address the Office of the Assessor in person will have the opportunity to do so via teleconferencing. The March Board of Review, the second step in the review process, begins March 8th and ends March 26th and will also be held remotely. Anyone who wishes to present to the Detroit Board of Review personally will have that opportunity through teleconferencing as well. Anyone with questions or wishing to challenge their assessments can email the Assessor’s office at Assessorreview@Detroitmi.gov

Residential Property Owners must begin the appeals process at the Assessors Review. Commercial, Industrial, and Personal Property owners may, if they chose, proceed directly to the Michigan Tax Tribunal. The deadline to appeal directly to the Michigan Tax Tribunal is May 31st.

To file an appeal by email: assessorreview@detroitmi.gov

To file an appeal online: www.detroitmi.gov/aborappeal2022

(available February 1 through 22)

To file an appeal by mail (must be received in the Office of the Assessor by close of business Feb 22, 2022:

City of Detroit

Office of the Assessor – ABOR

2 Woodward Ave Suite 804

Detroit MI 48226

Original source can be found here.

Source: City of Detroit

Alerts Sign-up

Alerts Sign-up